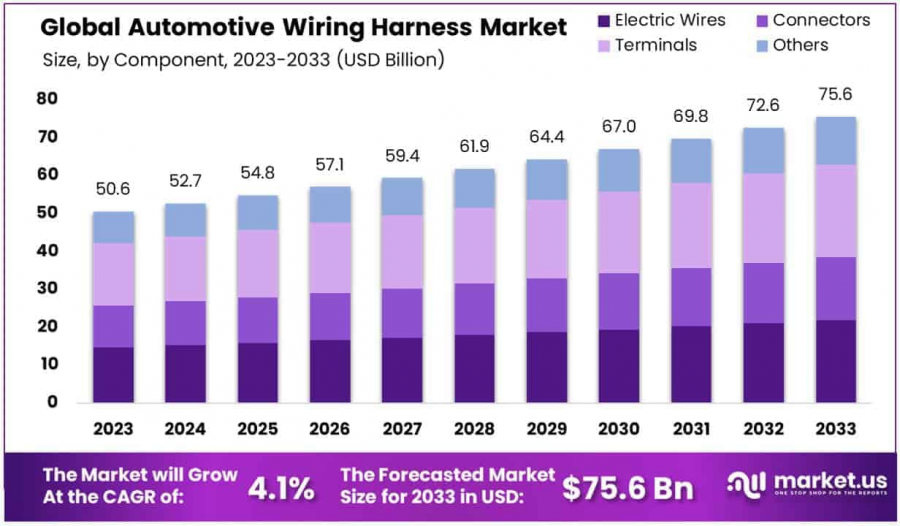

Automotive Wiring Harness Market Poised for 4.1% CAGR Growth Reaching USD 75.6 Billion by 2033

Automotive Wiring Harness Market size is expected to be worth USD 75.6 Bn by 2033, from USD 50.6 Bn in 2023, growing at a CAGR of 4.1% during forecast period.

NEW YORK, NY, UNITED STATES, January 29, 2025 /EINPresswire.com/ -- Report Overview

According to the report by Market.us, the Global Automotive Wiring Harness Market is projected to grow substantially, expanding from USD 50.6 Billion in 2023 to approximately USD 75.6 Billion by 2033. This growth is underpinned by a steady compound annual growth rate (CAGR) of 4.10% during the forecast period from 2024 to 2033.

Automotive wiring harnesses, essential as the vehicle’s central nervous system, consist of structured sets of wires, terminals, and connectors that transmit power and information throughout the vehicle. They enable the seamless functioning of various components such as headlights, engines, and entertainment systems, thereby enhancing vehicle performance and reliability.

The market is predominantly driven by advancements in automotive technology, including the electrification of vehicles and the rise of autonomous driving systems, which necessitate more complex and efficient wiring solutions. The surge in demand for electric vehicles (EVs) significantly propels the market, as EVs require sophisticated wiring harnesses to manage high voltages and connect multiple batteries and motors. Additionally, safety enhancements in vehicles, such as advanced driver-assistance systems (ADAS), increase the demand for reliable and high-quality wiring harnesses to support sensors and cameras critical for vehicle safety and functionality.

Asia Pacific leads the market with a dominant 47.3% share in 2023, generating USD 23.93 Billion in revenue. This leadership is driven by rapid industrialization, extensive automotive manufacturing, and significant investments in vehicle innovation in countries like China, Japan, and South Korea. Government initiatives, such as the Production Linked Incentive (PLI) schemes and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) program, further bolster market growth by promoting sustainable automotive technologies.

Despite challenges such as high production costs and stringent environmental regulations, the Automotive Wiring Harness Market remains poised for robust expansion, fueled by continuous technological advancements and the increasing adoption of electric and autonomous vehicles worldwide.

🔴 𝗛𝗮𝘃𝗲 𝗤𝘂𝗲𝗿𝗶𝗲𝘀? 𝗦𝗽𝗲𝗮𝗸 𝘁𝗼 𝗮𝗻 𝗲𝘅𝗽𝗲𝗿𝘁 𝗼𝗿 𝗧𝗼 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱/𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲, 𝗖𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲 - https://market.us/report/automotive-wiring-harness-market/request-sample/

Key Takeaways

- The Global Automotive Wiring Harness Market is expected to grow from USD 50.6 Billion in 2023 to USD 75.6 Billion by 2033, achieving a CAGR of 4.10%, driven by the increasing complexity and electrification of automotive systems and the rising demand for electric and autonomous vehicles.

- In 2023, Terminals dominated the By Component segment of the Automotive Wiring Harness Market, holding a substantial 32.4% share, underscored by their critical role in ensuring reliable connections and efficient power distribution across various vehicle systems.

- Chassis led the By Application segment in 2023, securing a 34.5% market share, highlighting the essential role of wiring harnesses in integrating control systems and providing structural support for mounting various automotive components.

- Passenger Cars held the dominant position in the By Vehicle Type segment of the Automotive Wiring Harness Market in 2023, accounting for 58.4% of the market, driven by the high volume of passenger vehicle production and the increasing integration of electronic systems in personal transportation.

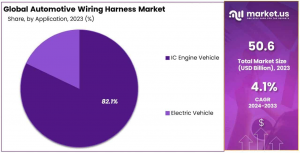

- IC Engine Vehicles dominated the propulsion segment in 2023, capturing an 82.1% share, reflecting the continued prevalence of internal combustion engines and the corresponding demand for sophisticated wiring harness solutions to support advanced engine technologies.

- Metallic materials held a dominant 72.4% share in the By Material segment of the Automotive Wiring Harness Market in 2023, attributed to the superior electrical conductivity and durability of metals like copper and aluminum in automotive electrical systems.

- Asia Pacific maintained its leadership in the Automotive Wiring Harness Market with a 47.3% share in 2023, driven by robust automotive manufacturing, technological innovation, and supportive government initiatives in key economies such as China, Japan, and South Korea.

Regional Analysis

Asia Pacific dominates the Global Automotive Wiring Harness Market with a commanding 47.3% market share in 2023, generating USD 23.93 Billion in revenue. This dominance is driven by rapid industrialization, extensive automotive manufacturing, and substantial investments in vehicle innovation in countries such as China, Japan, and South Korea. The region benefits from a robust supply chain, advanced technological adoption, and a strong focus on sustainability, which enhances the performance and durability of automotive wiring harnesses.

Additionally, the increasing integration of electric vehicles (EVs) and the proliferation of renewable energy projects further bolster market growth in Asia Pacific. Government initiatives supporting industrial growth and smart city developments also contribute to the region's leadership, ensuring sustained demand for advanced wiring harness technologies throughout the forecast period.

Report Segmentation

By Component

In 2023, Terminals held a dominant position in the “By Component” segment of the Automotive Wiring Harness Market, capturing a 32.4% share. This dominance is attributed to the critical role terminals play in ensuring reliable connections and efficient power and data distribution across various vehicle systems. Connectors followed closely, representing a significant portion of the market, essential for securing multiple wiring interfaces and enhancing the overall system’s robustness against environmental factors. Electric Wires, fundamental for transmitting electrical power and signals throughout the vehicle, also constituted a substantial share, emphasizing their indispensability in automotive electrical frameworks.

The category labeled as Others, which includes various minor components crucial for specialized applications or advanced technology integrations, held the smallest share but remains vital for addressing specific market needs and innovations. The segmentation within the Automotive Wiring Harness Market highlights the diverse technological demands of modern vehicles, from basic connectivity to complex systems integration. The dominance of Terminals underscores the industry’s focus on durability and efficiency, essential for supporting the next generation of electric and autonomous vehicles. As automotive technologies evolve, each component’s role is likely to shift, reflecting new standards in vehicle design and consumer expectations.

By Application

In 2023, Chassis held a dominant market position in the “By Application” segment of the Automotive Wiring Harness Market, with a 34.5% share. This segment’s prominence is due to the chassis’ integral role in integrating various control systems and providing the structural base for mounting components. Following closely, the Engine segment accounted for a significant share, driven by the complexity of modern engines that require sophisticated wiring harnesses for optimal performance and efficiency. HVAC systems also captured a notable portion of the market, reflecting the increasing demand for advanced climate control technologies in vehicles.

Other segments like Body, Roof, Door & Window, Facia, Seat, and Sensors, though smaller in market share, are crucial for their specific functions. These components support the vehicle’s overall functionality and enhance the driver’s experience through improved safety, comfort, and performance. The diverse applications of wiring harnesses in these areas underscore the market’s adaptability and the automotive industry’s shift towards more electrified and digitally connected vehicles. As automakers continue to innovate, the wiring harness market will likely see shifts in segment dominance, aligning with evolving automotive technologies and consumer preferences.

By Vehicle Type

In 2023, Passenger Cars held a dominant market position in the “By Vehicle Type” segment of the Automotive Wiring Harness Market, commanding a 58.4% share. This leading position reflects the substantial volume of passenger cars produced globally, each requiring extensive wiring harness systems to support a growing array of electronic functions from safety systems to infotainment. Commercial Vehicles also secured a significant market share, driven by the increasing adoption of advanced electronic systems in buses and trucks for enhanced operational efficiency and compliance with emission standards.

Light Commercial Vehicles (LCVs) and Heavy Commercial Vehicles (HCVs) collectively form another vital component of the market. These vehicles are increasingly equipped with sophisticated electronic devices for better fleet management and real-time monitoring, further expanding the demand for reliable and efficient wiring harness solutions. The distinction between LCVs and HCVs in the market segmentation highlights differing technological needs and customization levels required by varying vehicle sizes and uses. Overall, the Automotive Wiring Harness Market’s landscape is significantly shaped by the rise in electronic content per vehicle, stringent automotive standards, and consumer demand for high-performance, feature-rich vehicles. The dominance of the Passenger Cars segment underscores the broader trend toward vehicle electrification and automation, driving continuous innovations and growth in the wiring harness industry.

By Propulsion

In 2023, IC Engine Vehicles held a dominant market position in the “By Propulsion” segment of the Automotive Wiring Harness Market, with a commanding 82.1% share. This substantial share underscores the pervasive use of internal combustion engines across the global automotive sector, despite the growing interest in electric vehicles. IC engines continue to be the backbone of transportation, necessitating complex wiring harness systems to manage everything from basic engine functions to advanced emissions control and fuel efficiency technologies.

Conversely, the Electric Vehicle segment, while smaller, is rapidly gaining market share due to increasing investments in EV technology and supportive environmental policies. Electric vehicles require specialized wiring harnesses designed to handle higher voltages and the complex interconnections of battery management systems, motors, and onboard charging systems. This segment’s growth is fueled by the automotive industry’s shift towards sustainable mobility solutions and the global push for reduced carbon emissions. The stark contrast in market share between IC Engine Vehicles and Electric Vehicles highlights the ongoing transition within the automotive industry, reflecting both the enduring prevalence of traditional propulsion systems and the dynamic growth potential of electric mobility.

By Material

In 2023, Metallic materials held a dominant position in the “By Material” segment of the Automotive Wiring Harness Market, capturing a 72.4% share. This significant market share is attributed to the durability, conductivity, and cost-effectiveness of metallic components, predominantly copper, which remains the standard in automotive electrical systems for its superior electrical conductivity and flexibility. Following closely, Aluminum, recognized for its lightweight properties, accounted for a substantial portion of the market. This material is increasingly favored in vehicle design to reduce overall weight and improve fuel efficiency, aligning with the automotive industry’s push toward sustainability. Other metals also play a critical role, particularly in specialty applications where properties like high-temperature resistance and additional strength are required.

Meanwhile, segments like Optical Fiber, including both Plastic Optical Fiber and Glass Optical Fiber, though smaller in share, are gradually emerging in the market. These materials are gaining traction for their ability to provide high-speed data transmission essential for advanced driver-assistance systems (ADAS) and in-vehicle infotainment systems. The material composition of wiring harnesses is a key factor in their functionality and performance, with Metallic materials leading due to their established use and reliability. However, as the automotive industry evolves towards more electric and digitally connected vehicles, the demand for advanced materials like optical fibers is expected to grow, reflecting broader technological shifts within the sector.

🔴 𝗣𝘂𝗿𝗰𝗵𝗮𝘀𝗲 𝘁𝗵𝗲 𝗖𝗼𝗺𝗽𝗹𝗲𝘁𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 𝗡𝗼𝘄 𝘄𝗶𝘁𝗵 𝘂𝗽 𝘁𝗼 𝟯𝟬% 𝗼𝗳𝗳 𝗮𝘁 https://market.us/purchase-report/?report_id=18925

Key Market Segments

By Component

- Electric Wires

- Connectors

- Terminals

- Others

By Application

- Body

- Roof

- Door & Window

- Facia

- Seat

- Engine

- Chassis

- HVAC

- Sensors

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- LCV HCV

By Propulsion

- IC Engine Vehicle

- Electric Vehicle

By Material

- Metallic

- Optical Fiber

Driving Factors

The automotive wiring harness market is driven by the increasing complexity of vehicle electrical systems and the rising demand for advanced safety and infotainment features. The surge in vehicle production, especially in emerging economies, boosts the need for efficient wiring solutions. Additionally, the shift towards electric and hybrid vehicles requires specialized wiring harnesses to manage high-voltage systems. Technological advancements, such as lightweight materials and improved connectivity, further propel market growth by enhancing vehicle performance and safety standards.

Restraining Factors

Despite growth opportunities, the automotive wiring harness market faces several restraining factors. High production costs associated with advanced materials and sophisticated manufacturing processes can limit profitability. Supply chain disruptions and the scarcity of raw materials, such as copper and plastics, may impede production efficiency. Additionally, stringent regulatory standards for vehicle safety and emissions increase compliance costs for manufacturers. Fluctuations in the automotive industry, including shifts in consumer preferences and economic downturns, can also negatively impact market demand.

🔴 𝗛𝗮𝘃𝗲 𝗤𝘂𝗲𝗿𝗶𝗲𝘀? 𝗦𝗽𝗲𝗮𝗸 𝘁𝗼 𝗮𝗻 𝗲𝘅𝗽𝗲𝗿𝘁 𝗼𝗿 𝗧𝗼 𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱/𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲, 𝗖𝗹𝗶𝗰𝗸 𝗵𝗲𝗿𝗲 - https://market.us/report/automotive-wiring-harness-market/request-sample/

Trending Factors

Current trends in the automotive wiring harness market include the integration of smart technologies and connectivity features, such as Vehicle-to-Everything (V2X) communication. The adoption of lightweight and flexible materials aims to reduce vehicle weight and improve fuel efficiency. There is a growing emphasis on modular wiring harness designs that allow for easier customization and scalability in vehicle manufacturing. Additionally, the rise of autonomous vehicles is driving the demand for more sophisticated and reliable wiring systems to support advanced driver-assistance systems (ADAS) and autonomous functionalities.

Investment Opportunities

The automotive wiring harness market offers significant investment opportunities in the development of innovative materials and smart wiring solutions. Investing in research and development for lightweight and high-performance harnesses can meet the demands of electric and autonomous vehicles. Expanding manufacturing capabilities in regions with growing automotive industries, such as Asia-Pacific, presents substantial growth potential. Additionally, partnerships with automotive OEMs to develop customized wiring solutions and leveraging Industry 4.0 technologies for enhanced production efficiency can drive market expansion and profitability.

Market Companies

The Global Automotive Wiring Harness Market is highly competitive, featuring a blend of established industry leaders and innovative new entrants striving to capture market share. Prominent companies such as Yura Corporation, Aptiv PLC, and Lear Corporation dominate the landscape with their extensive product portfolios that emphasize durability, efficiency, and technological advancement.

These companies invest heavily in research and development to introduce cutting-edge wiring harness solutions that cater to diverse automotive applications, including electric and autonomous vehicles. Their strong global presence, robust distribution networks, and commitment to sustainability enable them to effectively meet the evolving needs of the market. Additionally, these market leaders focus on strategic partnerships and acquisitions to enhance their technological capabilities and expand their market reach, ensuring their continued dominance and influence in the Automotive Wiring Harness Market.

Key Players

- Yura Corporation

- Lear Corporation

- Delphi Automotive LLP

- Fujikura Ltd.

- Sumitomo Electric Industries, Ltd.

- Samvardhana Motherson Group

- SPARK MINDA

- THB Group

- Nexans Autoelectric

- Yazaki Corporation

- PKC Group

- Furukawa Electric Co. Ltd

- Leoni AG

Conclusion

The automotive wiring harness market is poised for robust growth driven by advancements in vehicle technology, the rise of electric and autonomous vehicles, and increasing vehicle production globally. While challenges such as high production costs and stringent regulations exist, emerging trends like smart connectivity and lightweight materials offer substantial opportunities. Strategic investments in innovation, regional expansion, and collaborative partnerships can enhance market position and drive future growth. Overall, the market presents a dynamic landscape with significant potential for stakeholders to capitalize on the evolving automotive industry demands.

Lawrence John

Prudour

+91 91308 55334

email us here

Visit us on social media:

Facebook

LinkedIn

Distribution channels: Automotive Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release