Harding and Company – UPDATE - Tesla, Musk and the SEC – TSLA Stock Rebounds as Expected!

Tesla Inc. shares soared Monday after Elon Musk reversed course and settled with U.S. securities regulators over the weekend.

MANHATTAN, NEW YORK, UNITED STATES, October 2, 2018 /EINPresswire.com/ -- a surprising decision that put to rest the threat of his removal from a company inseparable from his name.As news of the settlement unfolded over the weekend, Mr. Musk also sought to rally employees in an email that stressed the electric-car maker is “very close to achieving profitability and proving the naysayers wrong.” He also wrote “but, to be certain, we must execute really well tomorrow (Sunday). If we go all out tomorrow, we will achieve an epic victory beyond all expectations,” according to a copy of the email disclosed in a securities filing Monday.

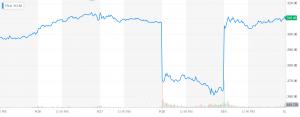

The stock surged 17% to close at $310.70, bouncing back from a 14% wipeout Friday after Mr. Musk was charged by the Securities and Exchange Commission over his Aug. 7 tweets suggesting he had secured funding to possibly take Tesla private. The regulator sued Mr. Musk, alleging that he misled investors.

The settlement, a stunning reversal after it appeared Mr. Musk would dig in to fight the SEC, forces him to step down as chairman for three years. The company is also expected to add two new independent directors to its board. That search is already under way, The Wall Street Journal has reported.

But as part of the deal, Mr. Musk, who is considered the creative engine of Tesla, gets to remain chief executive and stay on the board—positions that will allow him to continue wielding considerable influence over the company’s direction.

Mr. Musk and Tesla each agreed to pay a fine of $20 million.

The SEC also in the settlement called for Mr. Musk to submit to greater governance by Tesla over his communications.

It has been a roller coaster couple of weeks for Tesla and its CEO.

Harding and Company analyst Benjamin Williams said, “Despite all the furor, fundamentally Tesla is a Strong Buy with considerable upside in the future.” “The technological advantage over its competitors, brand image and ultimately, the belief of its CEO that they will change the landscape of personal transport are huge driving factors for investors.”

To find out how you can get involved in opportunities in the markets and specifically with Tesla, contact an advisor today at info@handcadvisors.com or visit www.handcadvisors.com to see how you can benefit from an independent advisory service that is 100% committed to your financial security, strategy and wealth management.

Jefferson Wilde

Harding and Company

+16469311975

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.